Buoyant Economies

Buoyancy Index

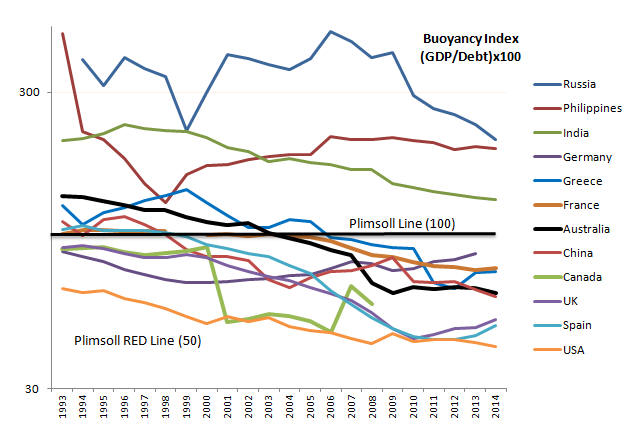

The Buoyancy Index is the ratio of GDP to Debt times 100. It reflects the ability of the economy to meet its domestic debts. When the economy can no longer support its domestic debts, it experiences a financial crisis.

The Plimsoll line is the line at which debt equals the level of GDP (Buoyancy Index of 100). When the Buoyancy Index falls below the Plimsoll line, the financial system is likely to be unstable. If it falls below 50, the country is likely to experience a financial crisis.

A falling Buoyancy Index indicates that the burden of debt in the economy is growing. A rising Buoyancy Index indicates that the economy is improving its ability to meet its debts.

The above chart uses a logarithmic vertical axis.

Growth of Debt and the Loss of Income in America

Original Posted: 30 March 2015

Last update: 31 March 2016