Buoyant Economies

Bank credit, interest rates and debt

Interest rates have been the main instrument of monetary policy for countries with floating exchange rates. However, with the growth of debt, the effectiveness of interest rates in controlling monetary growth has been diminishing.

The traditional model relies on the demand for credit rising as interest rates fall, thereby raising the money supply. This is shown in Figure 1 below.

Figure 1: Bank lending and interest rates

However, in countries with predominantly variable interest rates, such as Australia, interest rates also affect loan repayments. This is shown in Figure 2.

Figure 2: Loan repayments and interest rates

As interest rates rise, the capacity of existing borrowers to repay their debt declines. While the actual loan payments may rise, the higher interest rates can mean that more of their loan repayment goes to pay interest and less is available to repay the principal of the loan. There is a point at which the interest rate can be so high that the borrowers are not able to repay the interest. At that point, any increase in interest rates will mean that the cost of the additional interest is higher than loan repayments. Therefore, higher interest rates would actually increase borrower’s debts and thereby increase the money supply. The bank treats interest as income and distributes that income back to the economy to pay costs and distribute dividends.

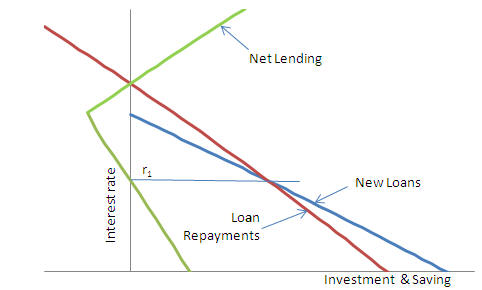

Loan repayments (of principal) represent savings in the economy. New lending is often called investment as it represents an injection of new money into the economy. The net increase in the money supply is equal to total new lending less loan repayments. This is shown in Figure 3.

Figure 3: Net growth in lending and interest rates

In Figure 3, net lending is shown to decline as interest rates rise. When interest rates reach a level where new lending ceases (at "a"), any further increase in interest rates will be ineffective at reducing the growth of new lending. Any increase in interest rates above "a" would continue to reduce loan repayments. When interest rates reach "b" loan repayments fall to zero. Any further increase in interest rates would mean that the cost of additional interest is greater than the amount of interest being repaid. In that situation, higher interest rates are an expansionary policy. The bank can treat that interest as income and use it to pay costs, taxes and distribute it as dividends.

Raising interest rates can be expansionary, also, if the rate at which loan repayments decline in response to the higher interest rates is greater than the decline in new lending. Such a situation is more likely if the economy has a high debt burden. In such circumstances, borrowers have less discretionary income available to pay the higher interest payments. Therefore, when interest rates rise, borrowers pay more in interest, leaving less to pay off the principal on their loans. This effect is shown in Figure 4.

Figure 4: Expanding growth in net lending and interest rates

The interesting implication from this situation is that lower interest rates can contract the growth of the money supply, increasing savings relative to monetary investment.

When net bank lending increases, total debt increases. In the process, the total amount of loan repayments increases and approaches the new loans schedule. Net lending (the growth in total loans) will fall to zero when loan repayments (of principal) rise to meet the new lending schedule.

When it does, bank credit would cease to grow for that level of interest. For example, if Figure 5, new lending is equal to loan repayments at interest rate “r1”. In this case, lowering interest rates would raise new lending (investment) by more than loan repayments (savings) leading to a rise in overall bank credit and the money supply.

Figure 5: Saturation of debt, net lending and interest rates

A policy of lowering interest rates to stimulate the economy does not provide a long term solution. Eventually, interest rates will fall to zero and debt will grow to such a level that loan repayments will equal the amount of new lending at that interest rate. At that point, the economy is fully saturated with debt and there are no other options to stimulate the economy.

Figure 6 shows this outcome. Interest rates have been reduced to zero at r0. At that level of interest, the rising debt shifts the loan repayments schedule to the right. Eventually, the economy reaches the point shown in Figure 6 where loan repayments equal new lending and the economy is fully saturated with debt.

At that point, the economy ceases to grow. This is likely to lead to a recession, as in the USA, or deflation as experienced in Japan. In both case, interest rate policy ceases to be an effective tool to manage the monetary system.

The resulting recession may lead to the situation where the demand for new loans falls below loan repayments. This will lead to a further contraction in the economy as it loses more money paying off debt than it recovers in the form of new loans.

Figure 6: Zero interest rates and debt saturation

Once this situation is reached, other mechanisms are required to stimulate the economy. Fiscal stimulus is just another means of raising bank credit. Similarly, quantitative easing is a temporary means of injecting additional funds into the economy. These measures do not provide a sustainable solution. They may provide temporary relief but they cannot sustain the economy and bring about prosperity.

The only long term sustainable alternative is to introduce a monetary system that provides monetary growth, and thereby economic growth, without raising debt. That can be achieved by the optimum exchange rate system, the guided exchange rate system or by returning to fixed exchange rates.

Home Other issues A more detailed description of the technicalities of debt

Impact of the floating exchange rate system on economic growth, wages, employment and trade.

USA Australia New Zealand Philippines

Originally posted: 21 August 2011

Last update: 12 July 2012